BY KAMAL KAUR

PHOTOS BY DHRUV SHAH

The Honourable Shyam Singh Rana, Minister for Agriculture in Haryana, India recently concluded a successful visit to Kenya, where he reaffirmed the shared commitment of both regions towards environmental sustainability and a greener future. The visit was focused on exploring mutual growth opportunities between Haryana’s agriculturesector and Kenya’s established agricultural framework.

The Haryana delegation, led by Minister Rana, toured various advanced farms, highlighting Kenya’s excellence, particularly in floriculture and horticulture. These visits were instrumental in identifying practical avenues for technical exchange and future collaboration with the agricultural sector in Haryana. The Minister noted the potential for integrating Kenyan expertise into Haryana’s farming practices to boost productivity and efficiency while adhering to sustainable methods.

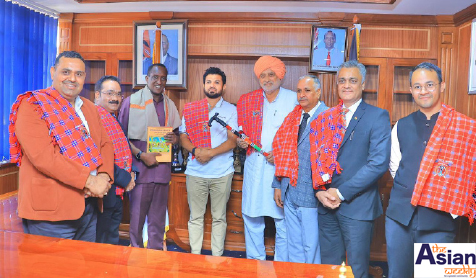

A key component of the trip was a vibrant interaction with the Haryanvi diaspora in Kenya, organised by the High Commission of India in Nairobi, where the High Commissioner Designate, Dr Adarsh Swaika, warmly welcomed attendees. Minister Rana expressed profound appreciation for the community’s significant contribution to Kenya’s national development, and strongly encouraged those present to remain connected with their roots and actively participate in India’s ongoing growth story.

The event, guided by Dr Kapil Kesari, also featured cultural highlights, including a lovely poem recited by Sarita Sharma, which captivated the audience, alongside an engaging local dance performance.

The Minister’s tour underscored a mutual desire to deepen ties not only in bilateral trade but also in sustainable agricultural practices. The successful engagement with both Kenyan officials and the diaspora has laid a strong foundation for future collaborations that promise mutual economic and environmental benefits.